Irs depreciation calculator

If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. Luckily the IRS provides quite a bit of guidance here so you dont have to guess at how long that new delivery van will last.

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Theyve put together a detailed table of standard useful life timelines.

. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Call 800-829-3676 to order prior-year forms and instructions. NW IR-6526 Washington DC 20224.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Leveraging Section 179 of the IRS tax code could be the best financial decision you make this year. As for the residence itself the IRS requires you to calculate depreciation over its 275 useful years using a different method called the modified accelerated cost recovery system.

So before inputting your values in the calculator tool check out Appendix B of this document to find the IRSs depreciation requirements. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange. IRS Depreciation Guidelines - This is a helpful article provided by the IRS that answers many questions related to depreciation of.

It will calculate straight line or declining method depreciation. Complete lines 1 and 2 for each property including the street address for each property. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document.

A P 1 - R100 n. Above is the best source of help for the tax code. For 2017 the maximum first-year depreciation write-off for a new not used car is 3160 plus up to an additional 8000 in bonus depreciation.

In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any outstanding penalties select the Due Date on which your taxes should have been paid this is typically the 15 th of April and lastly select the Payment Date the date on which you expect to pay the full. The propertys basis the duration of recovery and the method in which you will depreciate the asset. You can get forms.

The Car Depreciation Calculator uses the following formulae. See the Instructions for Form 4562 to figure the amount of depreciation to enter on line 18. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

MACRS Depreciation Calculator Help. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. Identify the propertys basis.

This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property. To use a home depreciation calculator correctly you must first identify three fundamental indicators. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

Here is how to use a property depreciation calculator step-by-step. Depreciation Calculator Pro has been fully updated to comply with the changes made by the Tax Cuts and Jobs Act TCJA legislation that affect the calculation of fixed asset depreciation Section 179 deduction First Year Bonus depreciation and Section 199A. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

How to use the calculator. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. Congress has a much less extravagant view of luxury.

If you have more than three rental properties complete and attach as many Schedules E as are needed to list the properties. We welcome your comments about this publication and your suggestions for future editions. Using the MACRS Tables.

Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Enter an assets cost and life and our free MACRS depreciation calculator will provide the expense for each year of the assets life. To prevent that the law squeezes otherwise allowable depreciation deductions for luxury cars But dont think Rolls Royce or Ferrari.

For example if you purchase a computer for 1500 you generally cant. We welcome your comments about this publication and suggestions for future editions. NW IR-6526 Washington DC 20224.

Do not resubmit requests youve already sent us. Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

Chapter 2 discusses depreciation as it applies to your rental real estate activitywhat property can be depreciated and how much. The IRS will process your order for forms and publications as soon as possible. Depreciation recapture is assessed when the sale price of an asset.

In addition the program prints IRS Forms 4562 and 4797 for use in tax return. It is the macrs depreciation method in which the depreciation rate is double the straight-line depreciation rate and also provides the highest tax deduction during the first few years and then changes to. Enter the data values separated by commas line breaks or spaces.

Enter the details of the required number of intervals and click on the. The IRS considers the useful life of a rental property to be 275 years so the amount of depreciation you can claim each year is your. Separate the cost of land and buildings.

Calculate your potential savings with. You can use this grouped frequency distribution calculator to identify the class interval or width and subsequently generate a grouped frequency table to represent the data. D P - A.

Use our 2022 Section 179 calculator to quickly calculate potential depreciation on qualifying business equipment office furniture technology software and other business items. Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income. Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate.

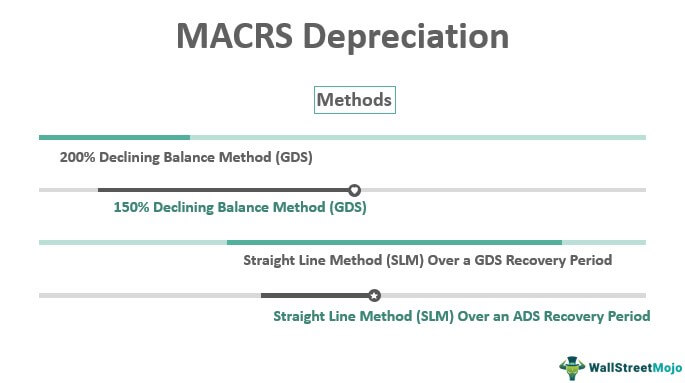

Calculating depreciation using macrs methods becomes easy with the ease of IRS depreciation calculator. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. 200 Declining Balance Method GDS.

The average car depreciation rate is 14. Property depreciation for real estate related to. Depreciation limits on business vehicles.

D j d j C. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Rather the IRS allows you to deduct only a portion of the cost each year over the number of years the asset is expected to last.

The depreciation formula is pretty basic but finding the correct depreciation rate d j is the difficult part because it depends on a number of factors governed. Section 179 deduction dollar limits.

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Macrs Youtube

How To Use Rental Property Depreciation To Your Advantage

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator With Formula Nerd Counter

Automobile And Taxi Depreciation Calculation Depreciation Guru

Double Teaming In Excel

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Guide To The Macrs Depreciation Method Chamber Of Commerce

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Schedule Template For Straight Line And Declining Balance

Excel Finance Class 85 Macrs Depreciation Asset Sale Impacts On Npv Cash Flows Youtube

The Mathematics Of Macrs Depreciation